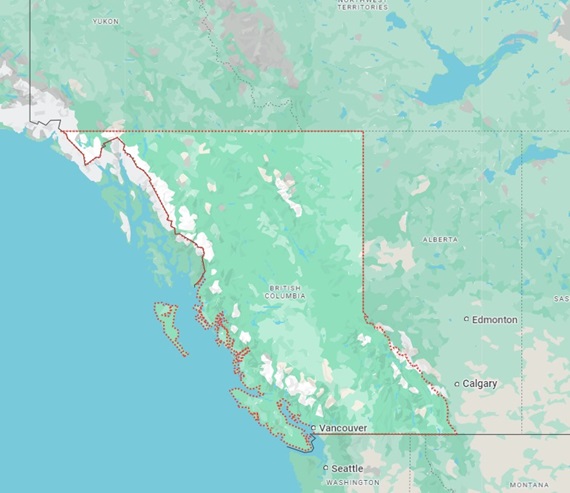

British Columbia (BC) is the westernmost province of Canada. With diverse landscapes and vibrant cities, British Columbia has one of the mot dynamic real estate market. With a population of over 5.4 million people, it has become a desirable place for domestic and international buyers. British Columbia hosts a diverse geography as a coastal province with the Pacific Ocean bordering it to the west. It shares provincial Boundaries with Alberta to the East, Yukon to the north and the Unites States to the South. The capital of British Columbia is Victoria and the largest, and the fastest growing, city is Vancouver.

Primary industries of the province that drive its economic growth include Forestry, Mining, Film and Television production, technology and tourism. At the heart of this economic development is Vancouver.

BC’s culture is a rich mix influenced by its Indigenous communities, European settlers, and significant immigration from Asia, particularly China and India. This multi-culturalism has shaped the dynamic and vibrant lifestyle found in cities like Vancouver and Victoria, known for their arts, food, and outdoor activities. While urban BC offers a fast-paced, cosmopolitan lifestyle, rural areas are prized for their slower pace and proximity to nature.

The province’s largest cities, Vancouver and Victoria, are the most desirable urban centres. However, regions like Kelowna and Kamloops are emerging as popular destinations with different lifestyles and real estate opportunities.

Real Estate

The Real Estate market in British Columbia is quite varied. In the metropolitan areas, a mix of residential options ranging from single-family homes to high-rise condos are available. Single-family homes, while still available, are becoming increasingly rare in urban settings like Vancouver due to land scarcity and the high cost of development. Consequently, condos and townhouses have become more popular in these areas.

Rural BC is home to more varied property types. In addition to agricultural land, there is also a growing market for recreational properties, particularly cottages and vacation homes.

Most Popular types of property in British Columbia

British Columbia offers a blend of metropolitan and rural areas. The Greater Vancouver area comprising of cities like Surrey, Richmond, Burnaby, Coquitlam, North Vancouver and West Vancouver. The larger share of apartment dwellers in the province come from this general area. Additionally, with growth in the market, apartments are more affordable in comparison to other living options and are therefore, preferable.

- Apartments: 65%

- Single family Homes: 19%

- Row Single Homes: 13%

- Semi-detached homes: 3%

Real Estate Trends

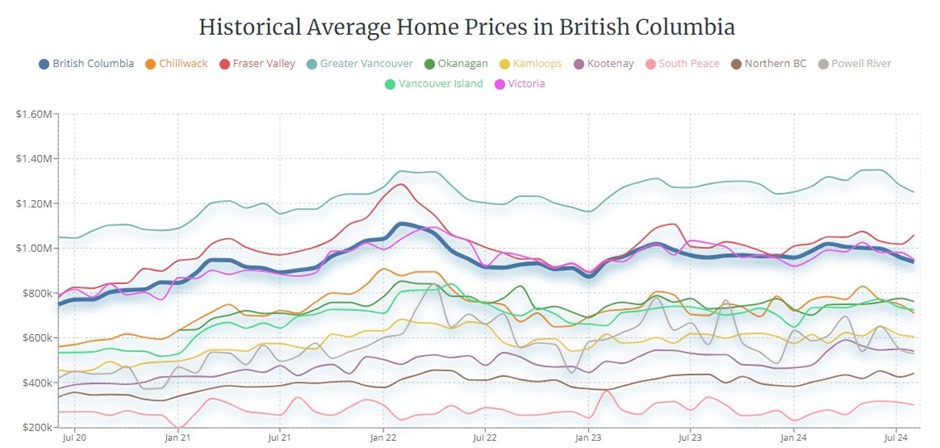

British Columbia’s market has seen an overall increase in the prices. However, the overall demand for housing in BC is on the rise and continues to outpace supply. Although the prices have been high, they also observe a variation over time. Currently the prices have seen a slight overall decline.

As of 2024, the average home prices in British Columbia have been 2% lower YoY. The benchmark prices have observed a similar decline of about 2.2% YoY. In August 2024, the benchmark home price was around CAD 972,700 and the average home price was around CAD 939,000. Fraser Valley is one location that has seen a significant increase of 6% YoY to CAD 1.06 million in average home prices. In contrast, Victoria’s average home prices have decreased by around 7% YOY to around CAD 948,000.

Even with the decrease in prices, there has been a decline in the number of sales in comparison to 2023, specifically for the month of August.

- Total Residential sales: 5,943 (10.0% decrease YoY)

- Total Listings: 41,343 (32% increase YoY)

Overall, British Columbia’s housing sales market has seen a decline with its Sales-to-new-listings (SNLR) dipping down to 14.4% which is down from 21.1% last year. Although, BC trends have been declining as a whole, the real estate demand is still there and the market is booming. The SNLR in Greater Vancouver, Chilliwack, BC Northern and Powell River, have all seen increases in the SNLR.

Rural and Urban areas in British Columbia

British Columbia’s real estate market can be split into two major categories: urban and rural. Urban centres like Vancouver, Victoria, and Kelowna are marked by high-density housing, particularly condos and townhouses. The scarcity of land in these areas has led to high-rise developments becoming the norm, particularly in Vancouver, where space is at a premium.

Financial Considerations

In the last five years, the mortgage market in British Columbia has seen significant shifts in interests and affordability challenges. With some of the highest housing prices in the country, the mortgage payments are a significant burden on BC homeowners, particularly in urban areas like Vancouver. Since 2022, British Columbia had observed a climb in the mortgage rates, specially the variables.

BC has the highest average mortgage loan value in Canada, as of 2023. This value was at CAD 454,516, in comparison to CAD 327,899 national average.

As of October 2024, the lowest 1-year fixed insured mortgage rate is 5.74%, lowest 2-year fixed insured mortgage rate is at 4.99%, lowest 3-year fixed insured mortgage rate is at 4.09%, lowest 4-year fixed insured mortgage rate is at 4.20% and the lowest 5 year fixed insured mortgage rate is at 3.94%.

Rural areas, on the other hand, offer larger plots of land, single-family homes, and farming properties. Northern BC, Vancouver Island (outside of Victoria), and the interior regions like the Okanagan are popular for buyers seeking affordable real estate and a more relaxed lifestyle. These areas are attractive for those wanting to escape the high costs and fast pace of urban life, with a focus on outdoor activities such as hiking, fishing, and skiing. British Columbia has 167 municipalities and 27 regional districts that serve both the urban and the rural community. The 161 municipalities cover only 11% of its total landmass but our home to 89% of the residents of the province.

Property registration and taxes

As part of ownership or leasing of a property or manufactured home, one must pay the respective property taxes yearly, for each property.

The money from the property taxes helps in funding local programs and services including Police and Fire Protection, Emergency Rescue Services, Road Construction and maintenance, Garbage services, Recreation and community centers, Parks, Libraries, Schools, Hospitals. Check out more details at https://www2.gov.bc.ca/gov/content/taxes/property-taxes/annual-property-tax .

Furthermore, if you gain interest or purchase a property that is a part of the Land Title Office, a property transfer tax return has to be filed. This may include transaction types such as Agreement for sale, life estate, foreclosure, lease, fee simple, court order, Quit claim, lease modification, amalgamation, prepaid lease etc. More details may be found at https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax .

Zoning & Land Use:

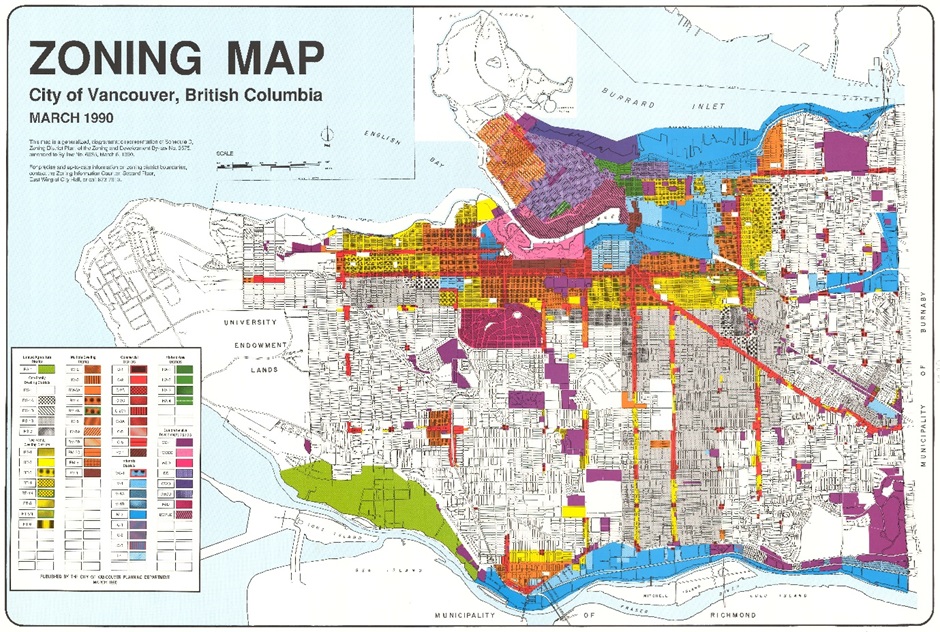

Zoning and Land Use include regulatory control on how the land can be used and hold guidelines on everything from development of residential neighborhoods to the designation of industrial zones. For example, Vancouver residential zoning is here as follows:

Zoning laws are governed at the municipal level, i.e. each city and regional may have slightly different regulations and bylaws. The different types of zoning in British Columbia:

- Residential Zoning – Encompasses everything from single-family homes to multi0unit apartment buildings.

- Commercial & Industrial Zoning – Commercial zoning includes retail, office spaces and restaurants. Industrial zones cover areas that are used for manufacturing, warehousing, and logistics.

- Mixed-Use Zoning – Few municipalities use mixed-use zoning which allows for a mix of residential, commercial, and industrial (on occasion) uses in the same area.

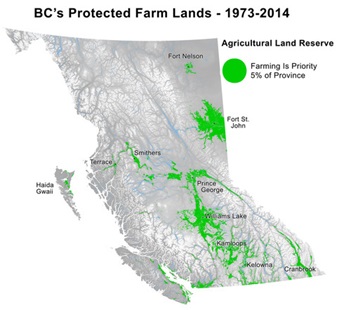

A significant portion of the land in British Columbia is protected by the Agricultural Land Reserve (ALR) which was established in1973 with the aim to preserve the province’s fertile land for agricultural use and prevent ‘urban sprawl’. Around 5% of British Columbia’s land is under ALR and the respective development in these areas is controlled.

Urban Containment Boundaries or Green Zones have also been established in few municipalities (Metropolitan areas) to limit urban sprawl. These zones prioritize environmental conservation along with protection of green spaces. This, however, limits the amount of land that is available for development outside the designated urban areas.

With the ongoing housing affordability crisis in BC,the municipalities are in the process of rezoning areas to promote development of more affordable housing options.

Popular Cities