Ontario is in Canada’s heartland and is the most populous province of Canada with over 14 million people calling it home. Situated in the Great Lakes region, it is the second largest province by area and is home to a diverse landscape ranging from populous metropolis like Toronto to the seemingly never-ending wilderness of Northern Ontario.

The province is home to Canada’s capital city Ottawa. The provincial capital of Ontario is Toronto.

The province is characterized by a mix of rolling hills, fertile plains, and the iconic Great Lakes shoreline over its expansive area of 892,412 km2. Northern Ontario is predominantly covered by the Canadian Shield, known for its rocky terrain, abundant lakes, and forests.

With warm and humid summers, snowy winters, and pleasant temperatures during spring and fall, Ontario offers beautiful weather and respective views all through the year. Major cities of the province include powerhouses of Toronto, Ottawa, Mississauga, Brampton, Kitchener-Waterloo, the Niagara Falls region and several others.

Ontario boasts a diverse industrial landscape and is essentially Canada’s economic engine. Key industries of the province include Manufacturing, Technology, Automotive, and Finance. Of course, the province is also major hub for education, healthcare, and tourism. Often referred to as “Silicon Valley North, it is home to a thriving tech ecosystem. A strong focus also remains on automotive production, aerospace, advanced manufacturing and food processing.

Real Estate

The Real estate and property market of Ontario, Canada has experienced significant fluctuations. Population growth, low interest rates and limited housing supply had contributed to the growth of the Real Estate market in cities like Toronto and Ottawa. In recent years, the market has observed a sift towards a more balanced state sue to increased housing supply and changes in government policies.

In some places, a depreciation has also been observed in property prices, however, the overall market is strong, especially in comparison to historical prices. Moreover, a numerous popular real estate areas are seeing resilient status of property costs.

Most Popular Types of properties

Apartments are the most popular type of home in Ontario followed by single family homes. With highly populated urban areas including Toronto and Ottawa, the demand for apartments is always high. Over the years, urban areas such as Toronto have seen a significant vertical growth.

- Apartments: 53%

- Singles: 27%

- Row single homes: 17%

- Semi-detached homes: 11

Real Estate Trends

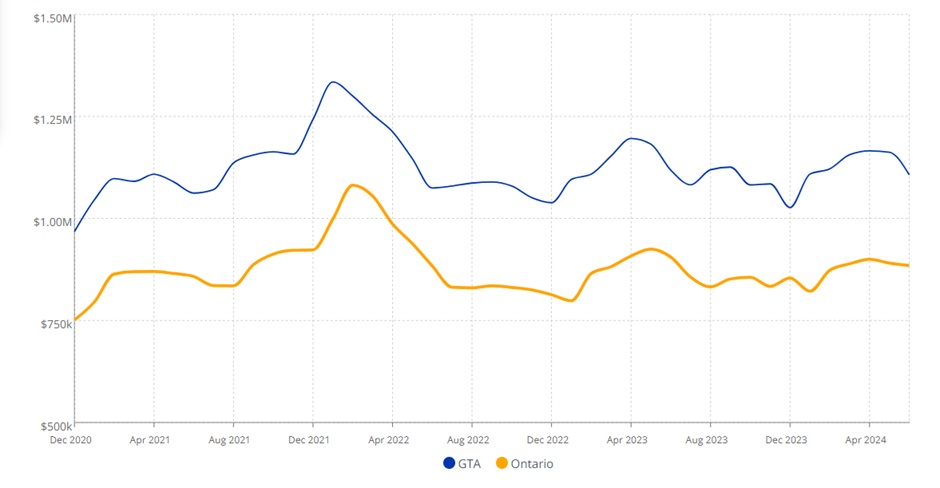

The popularity of urban areas such as the Greater Toronto Area (GTA) is evident through a comparison of average home prices in Ontario with that of the home prices in GTA.

As of July 2024, Ontario’s benchmark home price was down 4.3% Year-over-year at CAD 885,100 and average home prices decreased 2.3% year-over-year and culminated at about CAD 884,761. Greater Toronto Area (GTA) also saw a decrease in the average home price 1.7%. However, Ottawa’s average home price saw an increase of 2.4% year-over-year, reaching over CAD 686,535.

As of June 2024,

- Total Residential Sales – 16,060 (15.1% decrease Year-over-year)

- New Listings – 39,164 (5.1 % increase year-over-year)

- Active Listings – 61,524

- Sales to new listings ratio (SNLR) in June 2024 – 41%

The SNLR indicates a balanced market, which suggests a balanced buyer demand compared to seller supply in the housing property market.

Municipalities and local areas in Ontario

Ontario has Ontario has 49 census divisions 444 municipalities which, surprisingly, cover only 17% of the province’s land area. However, even more surprisingly, these 444 municipalities are home to almost 99% of its population. Overall Ontario has 3 types of municipalities:

- Upper Two tier municipalities – 30

- Lower Two tier municipalities – 241

- Single tier municipalities – 173

The largest municipality is that of Toronto (single tier), followed by Ottawa (single tier). The Upper tier municipalities have a total population of 7 million people and a land area of more than 87,135 km2. The upper tier municipalities further include 19 counties, 3 united counties, and 8 regional municipalities. Ontario has 173 single-tier municipalities comprising 32 cities, 23 municipalities, 28 towns, 85 townships, and 5 villages.

Financial Considerations:

As is the case with most places, the average mortgage rates in Ontario fluctuate based on the type of mortgage, lender and the term of the mortgage. However, the average mortgage data for Ontario Canada for the last 10 years or so, it was the average new mortgage amount for 10 years changes. The lowest mortgage rates in Alberta range between 4.2% – 6.0% depending on the term of the mortgage and the insurance status of the property.

With Ontario leading the country in population and real estate markets, almost all possible lending options are available in Ontario. This includes the Big 6 Banks of Canada (RBC, TD, Scotiabank, CIBC, BMO, and National Bank). In addition, with the more expensive housing markets, like the Greater Toronto Area (GTA), the private lenders also with a sizable portion of the lending capacity. Although Ontario is witnessing the citizens’ desire to find more open and greener spaces, there is still major movement to urban centres.

Property registration and taxes

Property registrations, land ownership, transfer procedures, taxes and levies are important aspects for any homeowner.

- Land Registration Details : https://www.ontario.ca/page/land-registry-offices-lro

- To search for property records (land ownership, mortgages and plans of survey), may have to also look at the Electronic Land Registration System (ELRS) : https://www.ontario.ca/page/search-land-property-records

- Property tax information is managed by the municipalities. More information can be found on the respective municipalities’ page and also through Municipal Property Assessment Corporation (MPAC)

Zoning & Land Use:

Zoning regulations and by-laws are governed at the municipality level. Zoning regulations dictate land use within municipalities (residential, commercial, industrial).

Popular Cities