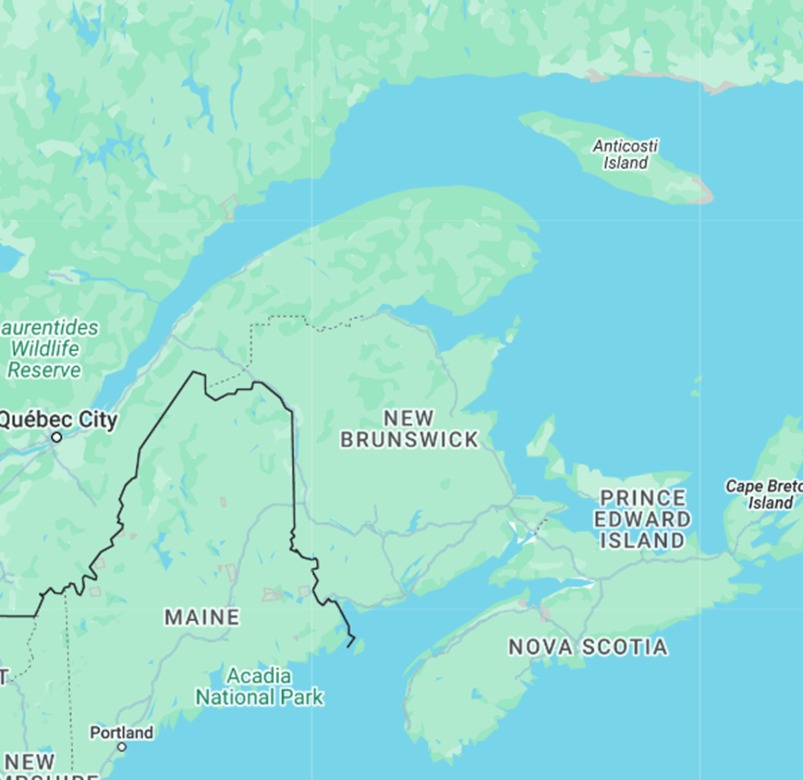

New Brunswick, one of Canada’s picturesque Maritime provinces, is celebrated for its blend of natural beauty, diverse communities, and affordability. Located on the east coast, it shares borders with Quebec, Nova Scotia, and the U.S. state of Maine, while offering access to the Atlantic Ocean. With a population of 850,894 people, the province’s key urban centers include Fredericton (the capital), Saint John, and Moncton, each of which contributes uniquely to the economy and lifestyle of the region.

The provincial economy is bolstered by industries such as forestry, fishing, manufacturing, and growing sectors like technology and tourism. New Brunswick is also recognized for its bilingual culture (English and French) and vibrant community traditions, which make it an attractive place for families, retirees, and young professionals. This cultural and economic diversity is reflected in the province’s real estate, which caters to a wide range of buyer needs

Real Estate

Real estate in New Brunswick is marked by affordability compared to the national average, making it a hotspot for first-time buyers and investors. The province offers an array of housing types, from modern condos in bustling city centers to charming family homes in suburban neighborhoods and rustic properties in rural areas. With steady growth in demand, the market has remained competitive but accessible, appealing to those relocating from pricier regions like Ontario and British Columbia.

The province has also seen an uptick in multi-family and investment properties, driven by the rise in rental demand in urban areas like Moncton and Fredericton. The ability to purchase investment properties at lower price points compared to other provinces has attracted both local and out-of-province buyers. New Brunswick’s real estate also includes commercial and industrial properties that align with its economic industries.

Most Popular Types of Property

Single-family homes remain the cornerstone of New Brunswick’s real estate market, particularly in suburban and rural regions where families seek spacious lots and privacy. These homes often feature large yards, making them ideal for outdoor living, which resonates with the province’s natural charm. In urban centers like Moncton, Saint John, and Fredericton, there is growing demand for condos and apartments, especially among young professionals and retirees looking for low-maintenance options.

Here is a breakdown of the most popular residence types in New Brunswick.

- Apartments: 41%

- Single family homes: 40%

- Semi attached homes: 13%

- Rows: 6%

About 83% of New Brunswick is forested and half of the population lives in urban areas. Apartments being more affordable, are the more popular choice.

Waterfront properties are another highly sought-after category, particularly in areas near the Bay of Fundy and along the Saint John River. These homes offer scenic views and proximity to nature, appealing to those looking for tranquility and a unique lifestyle. Rural properties, including farms and cottages, are also in demand, catering to buyers seeking affordable options away from city centers.

Real Estate Trends

New Brunswick’s real estate trends reflect steady growth, with the market maintaining resilience in the face of national fluctuations. Affordable homes, particularly those priced under CAD 300,000, have seen significant competition, with some properties receiving multiple offers. Urban areas like Moncton and Fredericton are experiencing rising demand, especially for entry-level homes.

New Bruncwick’s benchmark home prices reached CAD 318,500 towards the end of 2024. This is 9.5% year-over-year gain for the province from CAD 290,800 in late 2023. Being a Seller’s market as of late 2024, the SNLR was at 71%. The average home prices in New Brunswick were around CAD 322,246 which is a 7.6% increase year-over-year.

According to recent market data, New Brunswick saw an increase in year-over-year sales activity, with single-family homes leading the charge. The affordability factor has continued to attract buyers from other provinces, particularly during the pandemic, when remote work enabled many to relocate. Additionally, the rental market is growing, with increased demand for multi-unit residential properties as investors capitalize on the province’s competitive pricing.

Rural and Urban Areas

Urban areas like Fredericton, Moncton, and Saint John serve as hubs for employment, education, and culture. These cities offer a range of housing options, from family-oriented suburban homes to modern apartments and condos catering to professionals. The cities’ amenities, including healthcare, education, and entertainment options, make them attractive to a diverse demographic.

Rural New Brunswick, on the other hand, offers a completely different lifestyle. Properties in rural areas are more affordable and spacious, often featuring large lots or even farmland. These areas are popular among those looking for a quieter life surrounded by nature. The rural charm, combined with proximity to urban conveniences, allows buyers to enjoy the best of both worlds.

Financial Considerations (Mortgages and Interest Rates)

New Brunswick’s affordable real estate market means that monthly mortgage payments are often significantly lower compared to other provinces. Buyers can access a variety of mortgage products, including fixed and variable-rate options, through both national and local lenders. Provincial programs such as first-time homebuyer incentives and tax rebates help reduce the financial burden for those entering the market.

Current mortgage rates in New Brunswick are aligned with the national averages, though borrowers with higher credit scores may secure competitive deals. For investors, the lower property costs allow for attractive returns on rental properties, making the province a desirable destination for real estate investment.

Here is an overview of the mortgage rates as of late 2024. The best 1-year fixed insured mortgage rate in New Brunswick is 4.79%; the best 2-year fixed insured mortgage rate in New Brunswick is 4.69%; the best 3-year fixed insured mortgage rate in New Brunswick is 4.19%; the best 4-year fixed insured mortgage rate in New Brunswick is 4.49%; the best 5-year fixed insured mortgage rate in New Brunswick is 4.19%; the best 4-year variable insured mortgage rate in New Brunswick is 4.80%.

Property Registration and Taxes

The property registration process in New Brunswick is managed by Service New Brunswick, which oversees land titles, deeds, and related legal documentation. Buyers are required to pay a land transfer tax, calculated as a percentage of the purchase price, at the time of registration. This cost is typically lower than in other provinces, adding to New Brunswick’s affordability appeal.

Annual property taxes in New Brunswick are based on assessed property values and vary by municipality. These taxes fund local services such as education, infrastructure, and public safety. Buyers should factor in these taxes when budgeting for a home purchase, as well as other costs like home insurance and utility bills.

Zoning and Land Use

Zoning and land use in New Brunswick are governed by municipal bylaws that dictate how land can be used for residential, commercial, agricultural, or industrial purposes. These bylaws are designed to ensure sustainable development and balance urban growth with environmental preservation. Local councils play a key role in approving zoning changes, new developments, and land subdivisions.

Developers and homeowners must adhere to zoning guidelines when constructing or modifying properties. In rural areas, zoning often emphasizes agricultural or recreational use, while urban centers focus on mixed-use development to accommodate growing populations and businesses. The province’s zoning regulations aim to create harmonious communities while preserving New Brunswick’s natural beauty.